Table of Content

- Minimum Credit Score for a USDA Home Loan

- Achieve prequalification and preapproval for a USDA loan with a lender or mortgage broker

- More about USDA loan eligibility

- Understanding the USDA Home Loan Process

- Direct Attribution USDA Loan Process Step by Step

- What Else Should I Know About USDA Loans and Eligibility?

- How Long Does The USDA Home Loan Process Take?

Our loan officers are experienced with USDA loans and can help make the process easy for you. The USDA loan program considers both front and back-end DTI ratios. The front-end ratio considers only your proposed monthly housing cost in relation to the monthly income. The back-end ratio looks at all major monthly debts, including the new mortgage payment, compared to monthly income. Getting preapproved is a critical step in the homebuying process.

In other words, they’re low and competitive, but still take the time to shop around and get multiple rate quotes. Yes, but you’ll need to provide two years of tax returns to ensure it is stable and in the same line of work. They are sold as-is and may be subject to outstanding real estate taxes and assessments. While there typically isn’t a large inventory of homes for sale, you can search on their website in your desired state and county for available listings. The average savings via refi is $150 per month, and the USDA says some borrowers have saved as much as $600 a month, or $7,200 annually. You can use a loan calculator to determine the potential savings beforehand.

Minimum Credit Score for a USDA Home Loan

For manual underwriting, USDA benchmarks for DTI ratio are 29% for the front end and 41% for the back end. Buying a home is one of the single-largest investments in a person’s life – and also one of the most exciting. The actual time it takes to close your loan depends a lot on your financial situation, credit score, and property. However, if you have credit issues, property issues, or other things we have to work around and explain it can take longer.

Lenders are able to extend this seemingly risky financing option to borrowers thanks to a 90 percent loan guarantee provided by the USDA. Often, lenders will send an independent third party to verify the value of a property. This appraisal helps to determine if the home and property value is worth the loan amount. Once you’ve found a home meeting the qualifications, you’ll have to make an offer.

Achieve prequalification and preapproval for a USDA loan with a lender or mortgage broker

So although you’ll likely be anxious to get into your new home, it’s important to be prepared for delays and possible setbacks as you approach the final clear to close. Once you are preapproved for a USDA home loan, you’ll need to find a property that meets USDA home loan criteria. Armed with your preapproval letter, and the knowledge of what areas are eligible for a USDA loan, you and your agent will have no trouble securing your dream home. For USDA loans, lenders often look at 39 percent for a front-end ratio and 41 percent for the back-end. But guidelines and caps on DTI ratios can very by lender and other factors, meaning it's possible to have a DTI above these benchmarks and still qualify for a USDA loan.

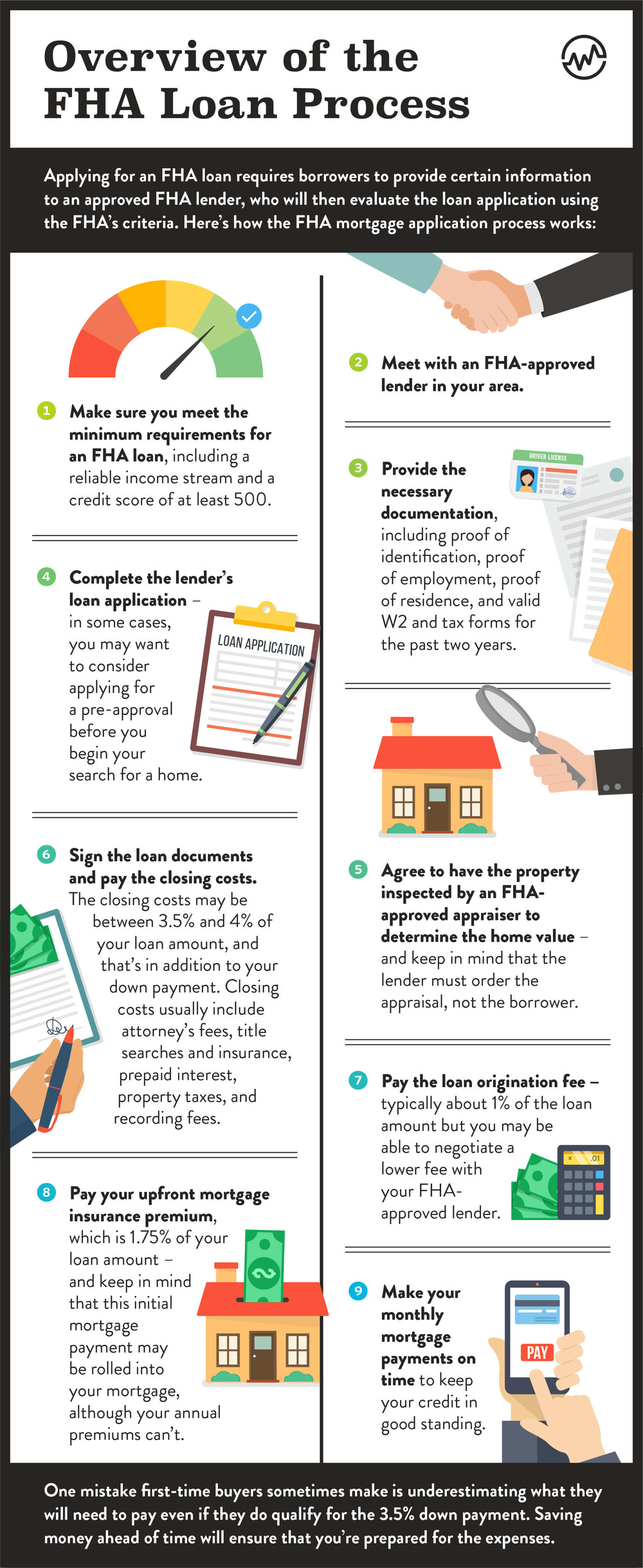

While there is no official minimum credit requirement to qualify for a USDA home loan, most approved lenders are looking for a FICO score of at least 640. But getting this guaranteed loan doesn’t mean you have to search out a government office to apply. Lenders around the country are endorsed by USDA to approve these loans. Bank loan officer to see if a USDA loan is the right choice for you. The USDA loan underwriting process kicks off after you hand your lender a signed purchase agreement. Your lender will order the USDA appraisal upon receiving your contract.

More about USDA loan eligibility

In order to be eligible for many USDA loans, household income must meet certain guidelines. Also, the home to be purchased must be located in an eligible rural area as defined by USDA. If the seller accepts your offer, then you’ll sign a purchase agreement, and your lender will order a home appraisal. The appraisal is different from a home inspection, and it’s a requirement for USDA loan approval. As the name itself implies, the USDA rural development loan promotes homeownership in eligible rural areas for both first-time home buyers and established borrowers alike. Your loan officer will most likely want to know your desired loan amount, monthly income, and monthly debts.

However, there are some general steps that can be followed in order to increase the chances of success. First, it is important to work with a lender that is experienced in handling these types of loans. Secondly, the borrower should be prepared to provide a detailed business plan and financial projections for the new construction project.

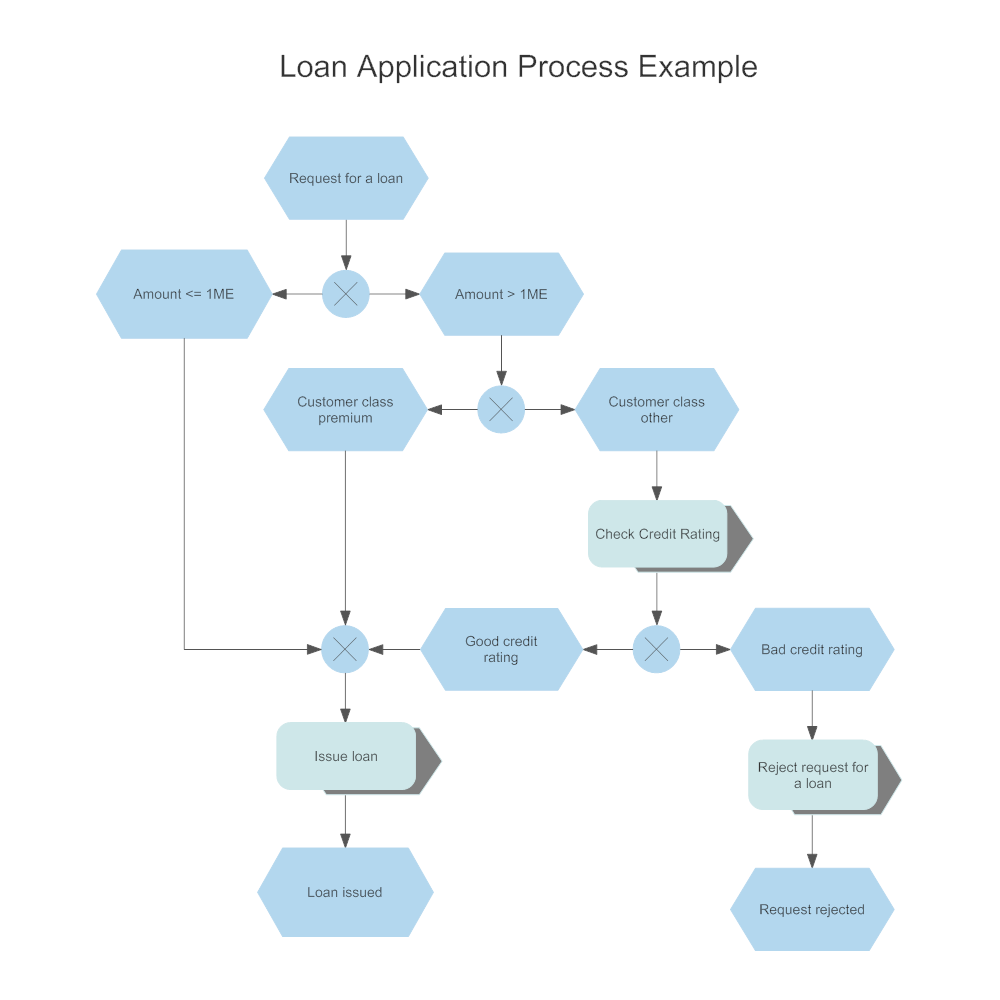

Understanding the USDA Home Loan Process

For a property to qualify for the loan, it needs to be outside a city or town. However, there is a little leeway if you’re slightly below it. Programs, rates, terms, and conditions are subject to change and are subject to borrower qualification.

To help potential homebuyers prepare for the USDA loan process, the major steps to getting a USDA loan are outlined below. Rural Development is not the loan program to use if you want to buy a fixer-upper. Once you’ve received your pre-approval, you are ready to go shopping! We recommend using a real estate agent to help you start your home search.

By enabling homeownership, the USDA helps create stable communities for households of all sizes. USDA loan rates are often lower than conventional 30-year fixed mortgage rates. This means a USDA loan is often more affordable overall than a comparable FHA or conventional loan. You can finance 100 percent of the home price with a USDA loan. However, if you do decide to make a down payment, you can lower your monthly mortgage payments and potentially afford a more expensive home. USDA rates are typically only matched by the VA loan, which is exclusively for veterans and service members.

People who are unable to obtain USDA loans are discouraged from doing so due to the geographic restrictions. The USDA loans are only available to people who live in rural areas, so anyone who wants to purchase a home in a more urban setting will have to deal with this issue as well. The 203 rehabilitation loan was created as part of the country’s housing crisis. Through this program, struggling homeowners can be assisted in improving their homes while lowering their long-term housing costs.

USDA loans work for homes in unincorporated rural areas and in small towns with populations of 10,000 or fewer. A lot of municipalities with up to 20,000 can qualify if the area is “rural in nature,” according to the USDA. The biggest drawback to USDA loans is that — unlike FHA and conventional loans — not everyone can apply for USDA-insured financing. If you’re happy with the home inspection — and if your lender’s underwriters are satisfied with your financials — it’s time to make the home purchase official.